Admirals (Admiral Markets) Review 2024

In the modern world of Forex trading, choosing the right broker is a pivotal moment for conducting business successfully. Recently renamed Admirals, the broker Admiral Markets has held high positions on the global Forex brokers' stage for many years. But what exactly makes this company so appealing to traders? And can you trust it with your funds?

This article will thoroughly review Admirals, exploring its key features, unique aspects, and services offered to traders. We will also assess the reliability and transparency of the company's operations so you can make an informed decision on whether to work with this broker. Join us in this exploration to learn more about the Admirals company and its offerings in Forex trading.

Admirals Broker Overview

| Foundation Year | 2001 |

|---|---|

| Official Website | https://admiralmarkets.sc |

| Regulated in Countries | Cyprus, Jordan, United Kingdom, Estonia, Australia, South Africa, Kenya, SeychellesMore Details |

| Minimum Deposit |

|

| Spread | from 0 points |

| Max Leverage | 1:1000 |

| Trading Assets |

|

| Trading Platforms |

|

| Email Support |

|

| Hotline Phones | |

| Social Media |

The Admiral Markets Group has provided clients with online trading services in Forex and CFDs on indices, stocks, and futures contracts for 13 years. The broker's representations can be found in 40 countries around the world.

The official website is available to users in 25 languages, including English, Arabic, Chinese, Spanish, Polish, Russian, and others.

Admirals Review Summary

Our evaluations in the Admirals broker review are based on a transparent and detailed methodology developed by our team of experts. This methodology encompasses many aspects, ranging from regulation and security to the broker's offered products, educational resources, quality of support, and much more.

We aim to provide you with the most comprehensive and up-to-date information to assist you in making an informed decision when choosing a broker. However, remember that it is always essential to conduct your research, as trading involves risk, and your investments can increase and decrease in value.

We hope that the information in this review will be helpful to you. Continue reading to learn more about the Admirals broker.

Reliability and Regulation

| Legal Entity | Regulator | Review |

|---|---|---|

Admiral Markets Cyprus Ltd Admiral Markets Cyprus Ltd | CySEC CySEC | Admirals EU review |

Admiral Markets AS Jordan Ltd Admiral Markets AS Jordan Ltd | JSC JSC | Admirals JO review |

Admiral Markets UK Ltd Admiral Markets UK Ltd | FCA FCA | Admirals UK review |

Admiral Markets Group Admiral Markets Group | EFSA EFSA | — |

Admirals AU Pty Ltd Admirals AU Pty Ltd | ASIC ASIC | Admirals AU review |

Admirals SA (Pty) Ltd Admirals SA (Pty) Ltd | FSCA FSCA | Admirals SA review |

Admirals KE Ltd Admirals KE Ltd | CMA CMA | — |

Admirals SC Ltd Admirals SC Ltd | SFSA SFSA | Current review |

Admirals is regulated by several leading regulators around the world, including CySEC (Cyprus), FCA (United Kingdom), and ASIC (Australia). This indicates that the company strictly adheres to international standards and regulatory requirements.

The segregation of client funds is a critical factor that ensures clients' funds are kept separate from the company's operational funds. This serves as an additional protection of clients' interests.

Moreover, the insurance of client funds up to USD 100,000 without additional commissions or costs indicates the company's responsible approach to protecting client assets.

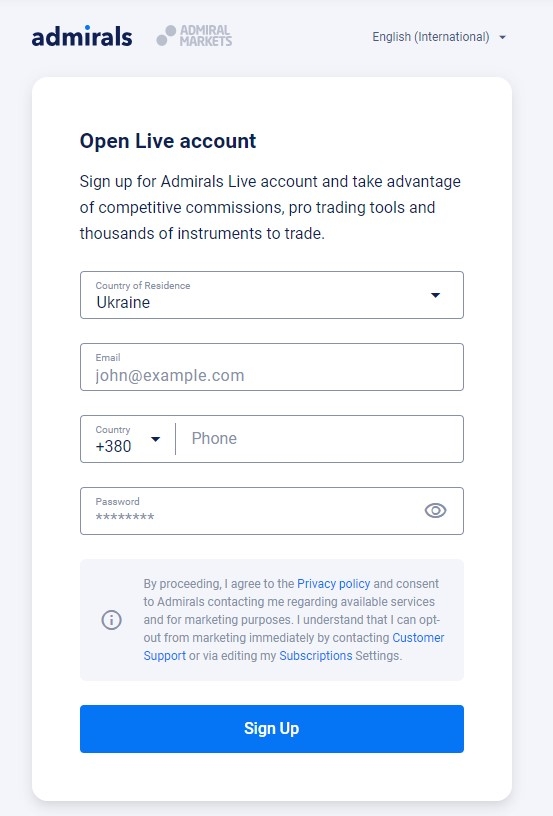

Account Opening

The simplicity of registration on Admirals and the low minimum deposit make the account opening process convenient and accessible for traders of all levels.

Registration

One should go through the client's area registration process before opening an account and working with an Admirals broker. Through this area, you manage your account, including depositing and withdrawing funds, participating in promotions, downloading software, and much more. The registration requires just a few details:

- Country of residence,

- Email address,

- Phone number,

- Password.

The information provided must match the identity documents for verification purposes; otherwise, you cannot go through the verification process to fully use the broker's services, including the withdrawal of profits.

Minimum Deposit

One of the essential aspects to consider when choosing a Forex broker is the minimum deposit size. At Admirals, this figure is only 25 US dollars, which makes access to the company's trading platforms possible even for beginner traders with limited capital.

Account Types

Admirals offers a broad range of accounts that can satisfy the needs of most traders.

However, the absence of cent accounts and accounts with fixed spreads may be a barrier for some traders, particularly beginners or those who prefer to know the spread size in advance.

Trading Accounts

The following trading accounts are available on Admirals:

| Zero.MT4 | Zero.MT5 | Trade.MT4 | Trade.MT5 | Invest.MT5 | |

|---|---|---|---|---|---|

| Account Currency | USD, EUR, GBP, AUD, BRL, MXN, CLP, SGD, THB, VND | USD, EUR | |||

| Minimum Deposit | 25 $25 €show all | 1 $1 € | |||

| Trading Platforms | MetaTrader 4 | MetaTrader 5 | MetaTrader 4 | MetaTrader 5 | |

| Spread | floatingfrom 0 pipsfor EURUSD~ 0.1 pips | floatingfrom 1.2 pipsfor EURUSD~ 1.2 pips | floatingfrom 0.6 pipsfor EURUSD~ 0.6 pips | floatingfrom 0 pips | |

| Commission per Trade | per 1 lot~ 3 $ | per 1 lot~ 0.02 $ | |||

| Trading Assets | ForexIndicesPrecious MetalsEnergy CarriersAgricultural Commodities | ForexIndicesCryptocurrencyStocksETFPrecious MetalsEnergy CarriersAgricultural Commodities | StocksETF | ||

| Opened Positions | up to 200 | up to 500 | up to 200 | up to 500 | |

| Leverage | 1:3-1:1000 | 1:1 | |||

| Margin Call / Stop Out | 100% / 30% | — / — | |||

| Order Execution | STP | DMA | |||

| Demo Account | |||||

| Islamic Account | |||||

| Open AccountRegister | Open AccountRegister | Open AccountRegister | Open AccountRegister | Open AccountRegister | |

The Trade account suits most traders, offering the most comprehensive range of trading instruments, including currency pairs, CFDs on cryptocurrencies, metals, energy carriers, indices, stocks, and ETFs.

The Invest account is ideal for those who prefer to invest in stocks and ETFs, featuring over 3000 stocks and more than 300 ETFs.

The Zero account suits traders looking for minimal spreads with a small commission per trade. It includes currency pairs and CFDs on metals, indices, and energy carriers.

Demo Account

To test one's knowledge in online trading without risking capital, one can start trading on a demo account from Admirals. This practice account allows you to change currency pairs, CFDs on stocks, and indices in real-time, but without funding the account.

The broker provides 10,000 virtual dollars for testing purposes. The demo account is valid for 30 days.

Islamic Account

The Islamic account at Admirals is designed explicitly for traders following the principles of Islam. It provides a full opportunity to trade Forex without violating religious principles. This is achieved by the absence of additional commissions charged or debited when trading CFDs on currency pairs, indices, raw materials, stocks, and ETFs.

The trading conditions on the Islamic account are identical to the standard Trade.MT5 account, including low spreads, fast execution of trades, and access to all trading instruments without any restrictions.

A vital feature of the Islamic account is the absence of swaps: no commission is charged or debited for carrying over open positions to the next trading day. Instead, a fixed account maintenance commission is charged for trades open for more than 3 days (1 day for exotic currency pairs). This allows traders to trade confidently, knowing their trading complies with Sharia principles.

VPS

Admirals offers its clients the option of using a Virtual Private Server (VPS). This service allows traders to take full advantage of the powerful trading platforms MetaTrader 4 and 5 Supreme Edition.

A unique feature of the Admirals VPS is that the first month of service is free (certain conditions apply). This provides new users an excellent opportunity to experience all the benefits of using a VPS in trading without any financial risk.

How to get a VPS from Admirals?

- Register by providing your name and email address.

- You must have a minimum of 5000 euros on your real trading account.

- After this, you will receive login details for the VPS and can start using it.

Commissions

Admirals' commissions can be considered average for the market. The commission per trade, spreads and swaps are pretty competitive. However, some additional fees, such as the inactivity fee or fees for internal transfers, may be significant in certain situations.

Trading Fees

Trading fees include the commission per trade and spreads with swaps.

Commission per Trade

For Zero accounts, the broker charges a commission of $3 per lot, an average fee in the market reflecting standard trading conditions.

Below is the commission per lot for the EUR/USD pair at different Forex brokers:

| Broker | IC MarketsRaw Spread | PepperstoneRazor | AdmiralsZero.MT5 | VantageRaw | RoboforexECN |

|---|---|---|---|---|---|

| Commission per lot | $3.5 | $3.5 | $3 | $3 | $2.16 |

Spreads and Swaps

On Trade accounts, the typical spread for the EUR/USD pair is 0.8 pips, which is relatively low. However, Admirals swaps are quite high compared to other brokers.

| Asset | Average spread | Swap long | Swap short |

|---|---|---|---|

| AUDUSD | 1.0 pips | -5.52 pips | 0.62 pips |

| EURUSD | 0.8 pips | -8.42 pips | 0.70 pips |

| GBPUSD | 1.0 pips | -4.88 pips | -2.99 pips |

| NZDUSD | 1.9 pips | -1.68 pips | -2.61 pips |

| USDCAD | 1.6 pips | -3.17 pips | -4.16 pips |

| USDCHF | 1.2 pips | 1.22 pips | -8.06 pips |

| USDJPY | 1.0 pips | 8.19 pips | -28.23 pips |

Cashback

Admirals offers an interesting Cashback program that allows traders to receive rewards for their trading activity. This program returns a portion of the trading volume directly to the client's account.

Admirals' Cashback system is straightforward. The trader receives $1 back into their account for every million dollars of notional volume traded. It is important to note that this offer is available for real trading accounts, including Trade.MT4, Trade.MT5, Zero.MT4, and Zero.MT5.

The advantage of this program is that traders do not need to take any additional actions to receive the cashback. The amount will be automatically credited to their trading account within the first five calendar days of each statement month.

Withdrawal Fee

Regarding fund withdrawals, one request per month is processed without a commission, after which a fee of 1% or 2% is charged (depending on the withdrawal method).

Inactivity Fee

Accounts with no transactions for 24 months and no open positions are subject to an inactivity fee of 10 EUR per month. This is charged only if the account balance is positive.

Other Fees

Admirals also charges a fee for internal transfers, which depends on the base currency of the accounts and the type of transfer, and a currency conversion fee of 0.3%. This fee is applied when dealing with stocks, ETFs, CFDs on stocks, and CFDs on ETFs quoted in currencies other than the base currency of your account.

Deposit and Withdrawal

Admirals provides many accessible methods for depositing and withdrawing funds, including popular payment systems and cryptocurrencies. This ensures convenience and flexibility for clients.

Also, deposit and withdrawal fees are often absent or minimal, which is a significant advantage for traders.

The only drawback is the commission for bank transfers for deposits less than 1000 USD or EUR and the fee for multiple withdrawals within a month.

Deposit Methods

| Payment System | Currencies | Deposit Fee | Operation Limit |

|---|---|---|---|

0% | from 25 to 100000 USDfrom 25 to 100000 EURfrom 25 to 100000 GBP. . .show all | ||

0% | from 25 to 100000 USDfrom 25 to 100000 EURfrom 25 to 100000 GBP. . .show all | ||

0% | — | ||

0% | — | ||

0% | from 25 to 150000 USDfrom 25 to 150000 EUR | ||

0% | from 25 to 150000 USDfrom 25 to 150000 EUR |

| Cryptocurrency | Blockchain | Deposit Fee | Operation Limit |

|---|---|---|---|

| BTC | 0% | — | |

| ERC20 | 0% | — | |

| ERC20 | 0% | — | |

| ERC20 | 0% | — | |

| TRC20 | 0% | — |

For all methods except bank transfer, there is no deposit fee.

For bank transfer deposits, the broker's commission is 25 USD/EUR if the deposit is less than 1000 USD or EUR. There is no commission for more extensive deposits.

Withdrawal Methods

| Payment System | Currencies | Withdrawal Fee | Operation Limit |

|---|---|---|---|

0% limitscommission limits | from 1 to 100000 USDfrom 1 to 100000 EURfrom 1 to 100000 GBP. . .show all | ||

0% limitscommission limits | from 1 to 100000 USDfrom 1 to 100000 EURfrom 1 to 100000 GBP. . .show all | ||

0% | — | ||

0% limitscommission limits | — | ||

0%+ 5

USD limitscommission limits | from 1 to 150000 USDfrom 1 to 150000 EUR | ||

0%+ 5

USD limitscommission limits | from 1 to 150000 USDfrom 1 to 150000 EUR |

| Cryptocurrency | Blockchain | Withdrawal Fee | Operation Limit |

|---|---|---|---|

| BTC | 0% | — | |

| ERC20 | 0% | — | |

| ERC20 | 0% | — | |

| ERC20 | 0% | — | |

| TRC20 | 0% | — |

Admirals allows for one commission-free withdrawal per month. Subsequent withdrawals incur a commission ranging from 1% to 2%, depending on the selected payment method.

Withdrawal requests are processed by the broker on the same working day if received before 17:00. Otherwise, the request is processed on the next working day.

Markets and Products

Admirals offers a relatively wide range of products for trading and investing.

Available Markets

The following CFDs are available for trading on Admirals:

| Broker | IC Markets | Admirals | Pepperstone |

|---|---|---|---|

| Forex | 61 | 82 | 97 |

| Precious Metals | 7 | 7 | 20 |

| Energy Carriers | 5 | 3 | 4 |

| Agricultural Commodities | 8 | 7 | 16 |

| Indices | 25 | 43 | 26 |

| Stocks | 2175 | 3428 | 986 |

| ETF | 38 | 362 | 108 |

| Bonds | 10 | 2 | — |

| Cryptocurrency | 21 | 21 | 30 |

Stocks and ETFs

At Admirals Broker, you can trade and invest in US stocks.

Stocks are available from the following exchanges:

- AMEX

- NASDAQ

- NYSE

When purchasing stocks, the commission is 0.02 USD per share, with a minimum of 1 USD per transaction. The broker offers its clients one free transaction every day.

Margin Requirements

The margin requirements on Admirals depend on the type of traded instrument and the nominal value of the position.

| Trading Instrument | Max. Leverage for Retail Traders |

|---|---|

| Forex | 1:1000 |

| Precious Metals | 1:500 |

| Energy Carriers | 1:500 |

| Agricultural Commodities | 1:50 |

| Indices | 1:500 |

| Stocks | 1:20 |

| ETF | 1:20 |

| Bonds | 1:20 |

| Cryptocurrency | 1:100 |

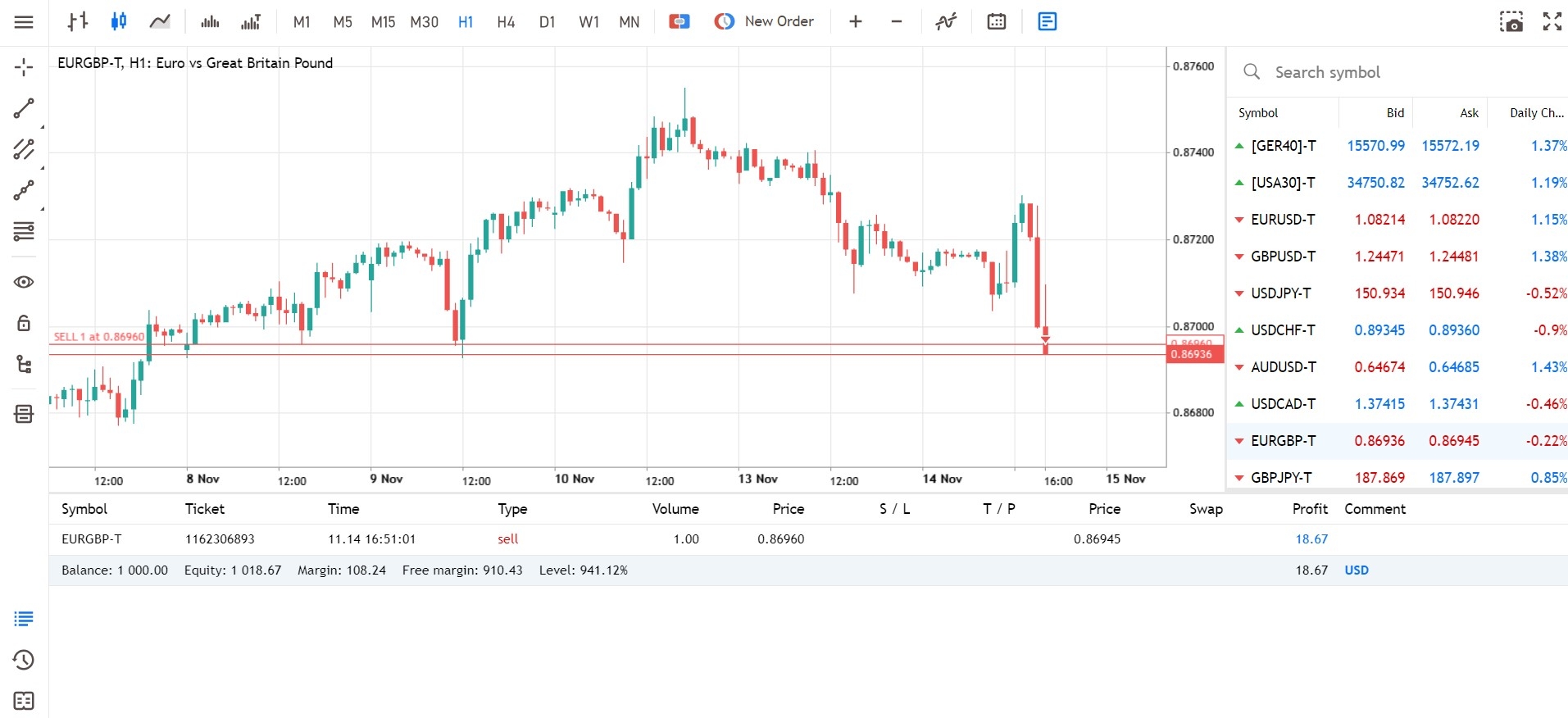

Trading Platforms

Admirals boasts the two most popular and powerful trading platforms - MetaTrader 4 and MetaTrader 5, providing a wide array of features and flexibility for traders of all levels.

The Admirals mobile app features an intuitive interface, offers all the essential functionalities, including real-time operations, and allows users to trade on the go.

However, the lack of additional unique platforms might be a downside for some traders searching for specialized or innovative solutions.

MetaTrader 4 and 5

Admirals provides access to the MetaTrader 4 and MetaTrader 5 platforms, which are global leaders in online trading. These platforms are well-suited for beginners and experienced traders thanks to their advanced features, including various technical analysis tools, flexible trading system settings, and algorithmic trading capabilities.

Admirals Mobile App

The Admirals mobile app is an excellent complement to the website, allowing trade on the go while staying updated with all market changes.

Its user-friendly interface, the capability to execute operations in real time, and features for managing open positions make this trading tool convenient and reliable for all users.

Moreover, the app provides all the essential functions, including the ability to scan credit cards and documents for quick account funding.

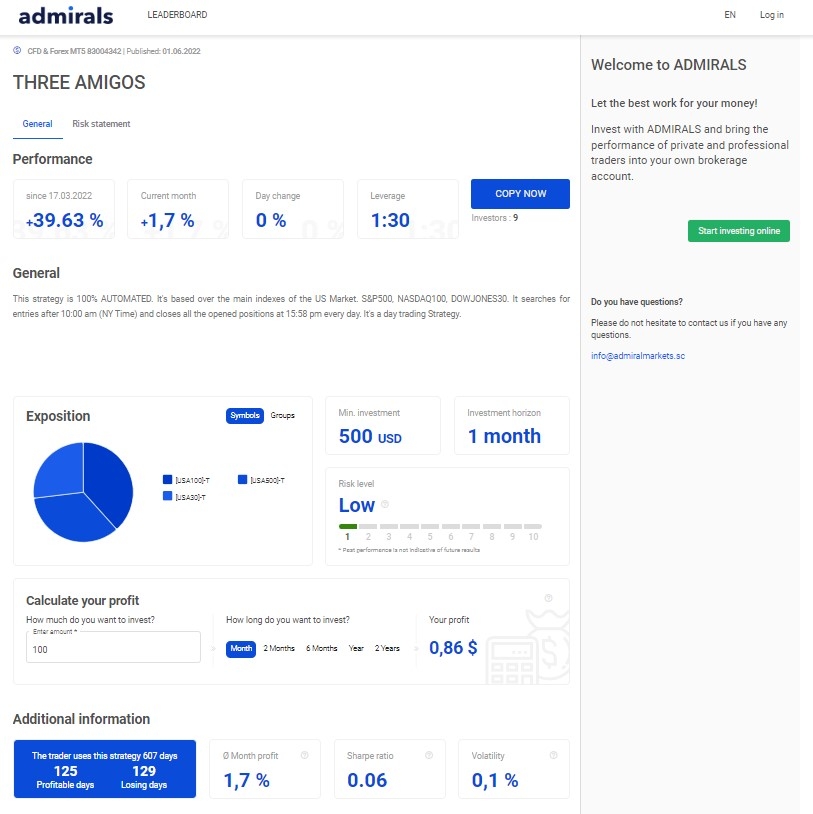

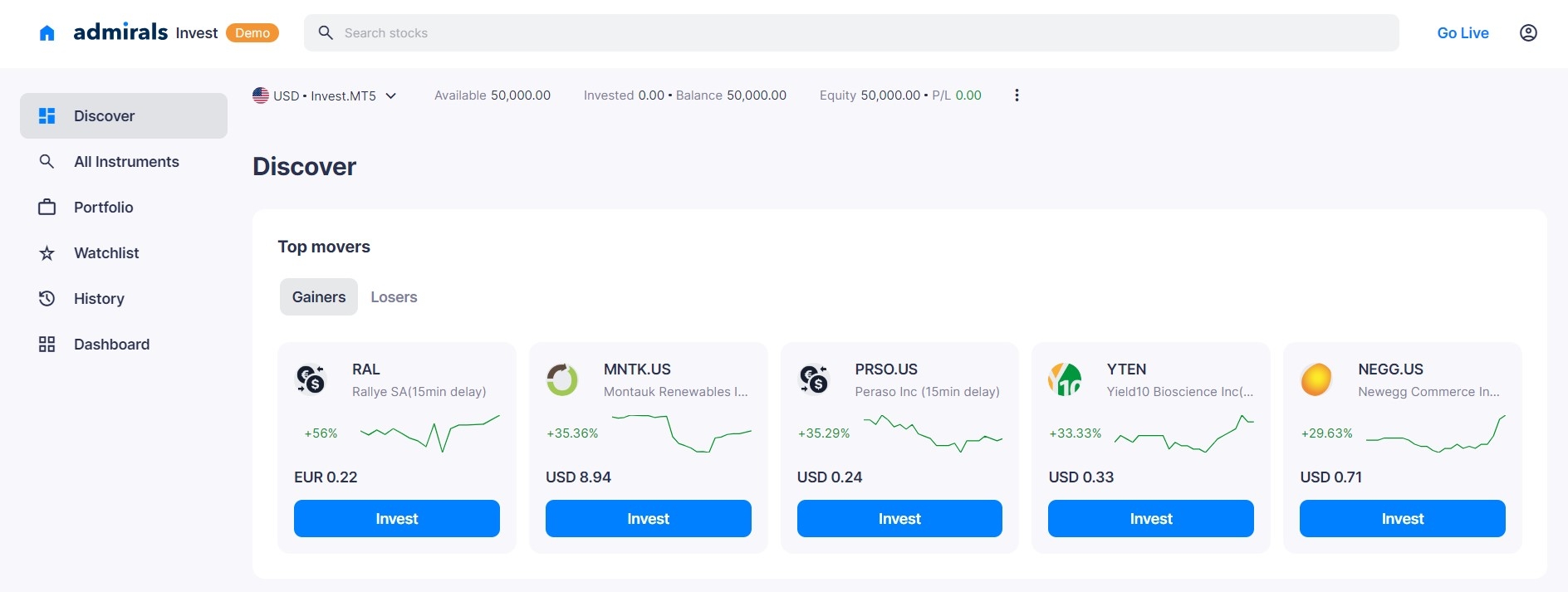

Admirals Invest

The asset management platform from broker Admirals represents a cutting-edge, innovative platform developed in collaboration with Finexware. This service is specifically designed for professional asset managers and small hedge funds that require a flexible and secure system for interacting with their investors.

The Admirals and Finexware asset management platform enables asset managers to use their professionally developed platform to manage assets. It offers the flexibility to configure various payout models, including performance-based, management, and subscription fees, while automating periodic payments.

Furthermore, asset managers can provide their investors high-quality service featuring convenient and transparent data visualization. They are granted access to high liquidity from Admirals, including over 2700 of the most popular trading instruments such as stocks, ETFs, and CFDs.

On the other hand, investors gain access to an intuitive platform with superior data visualization and detailed portfolio characteristics. They can flexibly manage settings and risk limits, follow any of the manager's strategies considering their risk parameters, and build a portfolio from different strategies.

It is important to note that the asset management service is distinct from the Copy Trading service. Asset management involves complete account management by the manager, while in Copy Trading, subscribers can trade independently and modify or close copied orders.

To become an asset manager on the Admirals platform, potential candidates must submit relevant documents that confirm their experience and qualifications. Admirals and Finexware then assess whether the candidate meets all the requirements.

Analytics

The broker provides an impressive volume of well-structured information about the markets in the analytics section. One can find reviews and forecasts in fundamental, technical, and wave analysis, an economic calendar, and currency exchange rates with spreads for different account types.

One can also discover market sentiment statistics and insights on major financial and economic news and trading schedules.

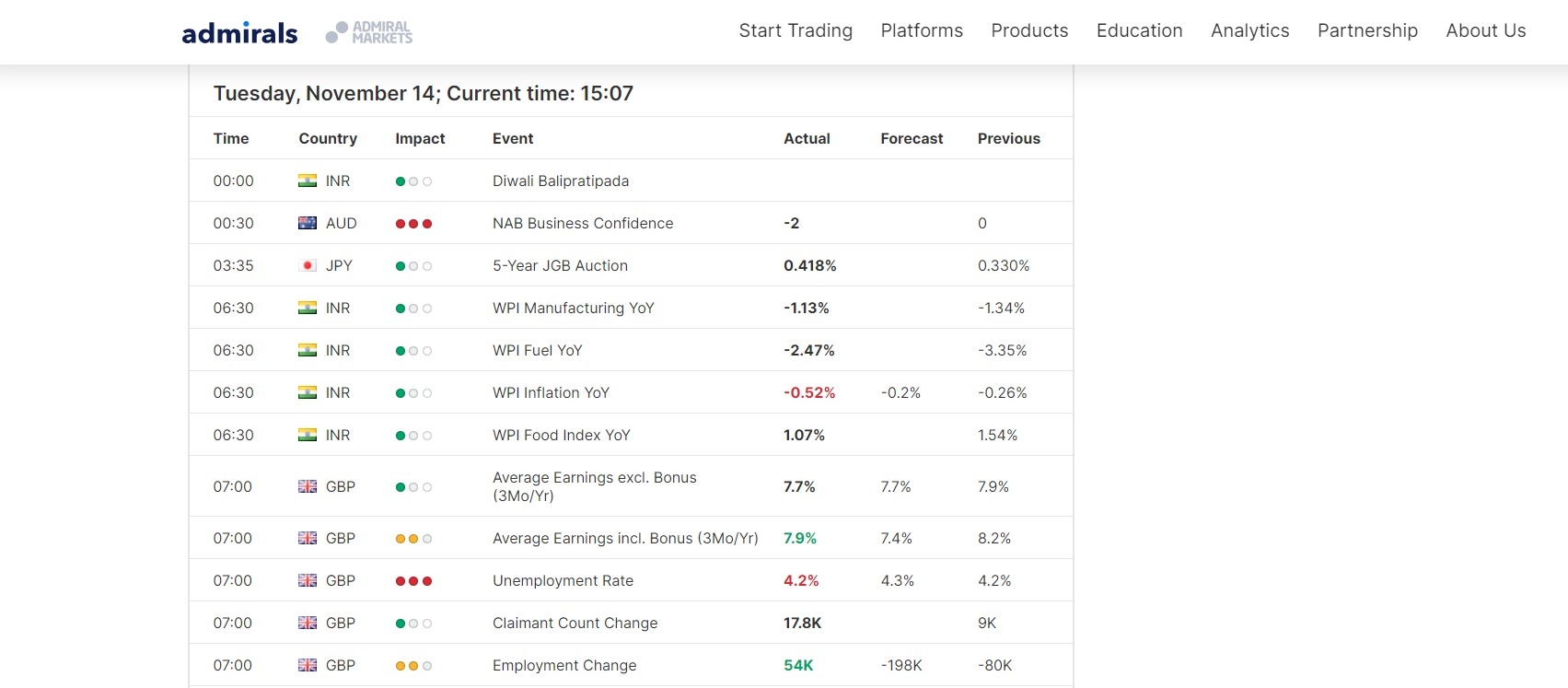

Economic Calendar

The Admirals economic calendar is a powerful tool for forecasting market trends. It enables traders to track crucial economic events and their impact on financial markets, significantly aiding in developing trading strategies.

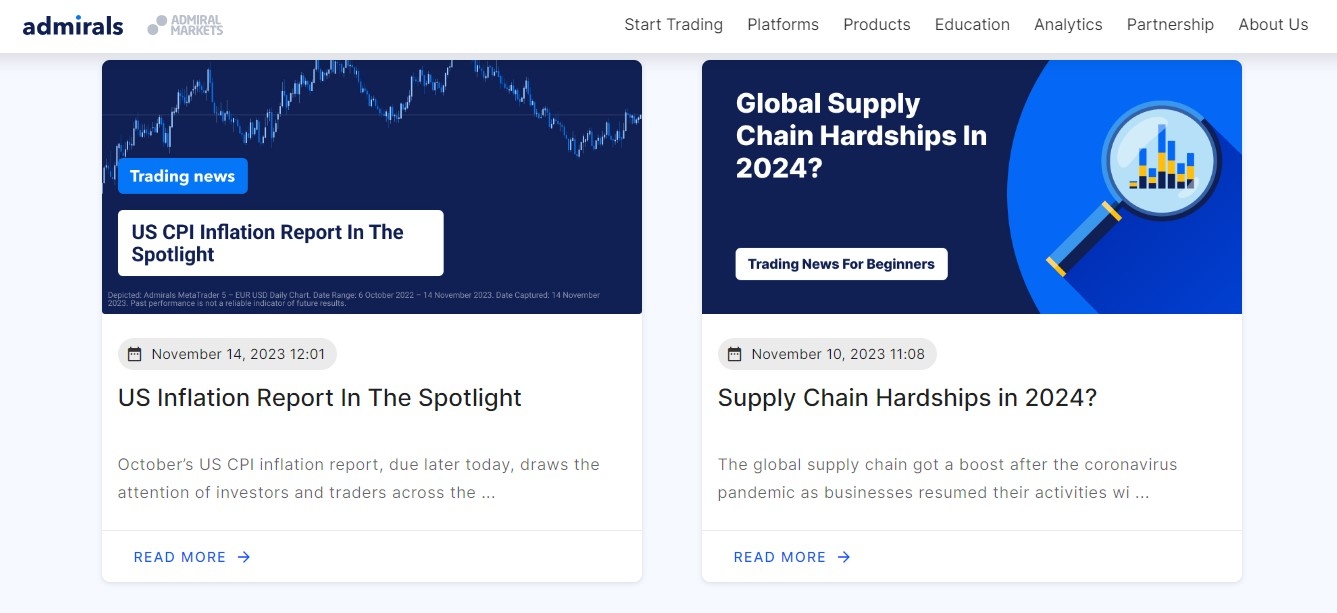

Trading News

Admirals’ trading news informs traders of the latest market changes, from major corporate mergers to central bank policies.

Such timely updates allow traders to quickly adapt to changing market conditions.

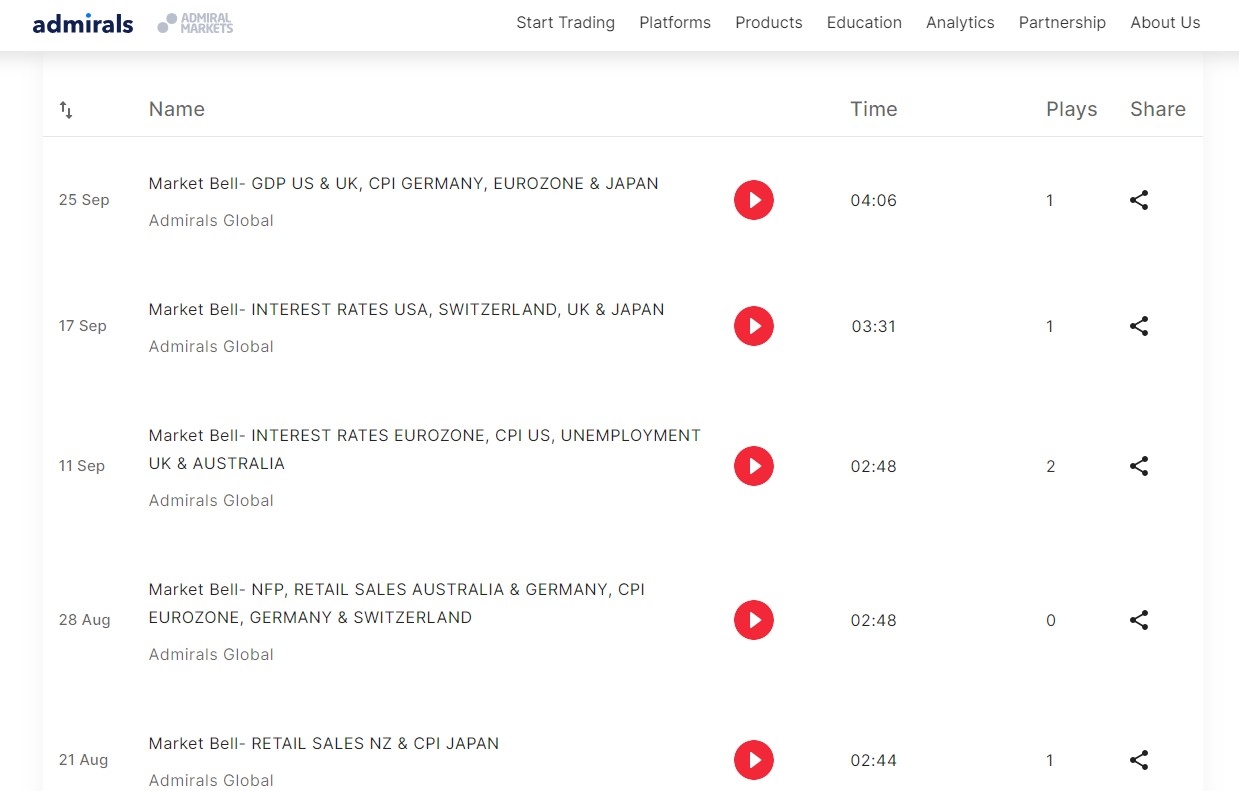

Weekly Podcasts

The weekly podcasts from Admirals are an excellent way to learn about the latest market news and upcoming significant events. These podcasts also offer helpful trading and investing tips, making them a valuable resource for traders at all experience levels.

Technical and Fundamental Analysis

Admirals provides detailed technical and fundamental analysis to help traders understand current market trends. This section includes daily analytical reviews from a team of professional traders, the search for statistical patterns in price changes, and the analysis of macroeconomic data that can affect the value of investments.

Education

Admirals offers a broad range of educational materials to enhance the trading skills of its clients.

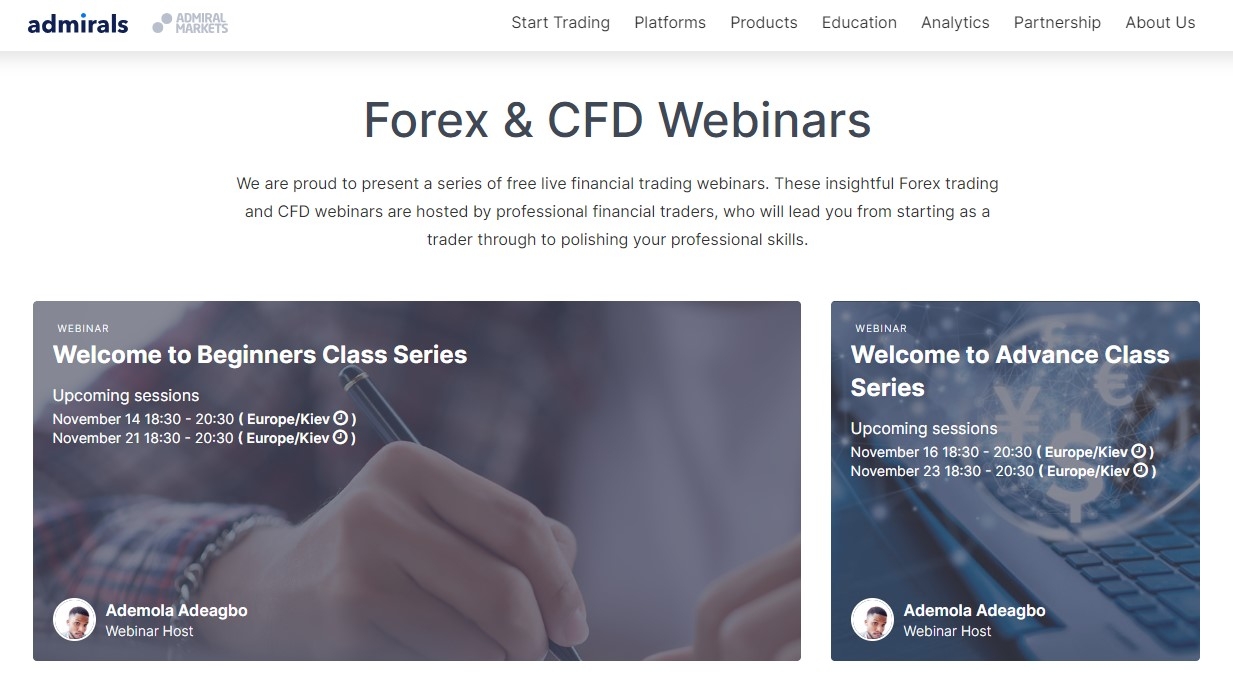

Webinars and Seminars

Admirals regularly conducts free webinars and seminars on Forex and CFD trading. These educational sessions cover everything from trading fundamentals to more complex topics such as technical and fundamental analysis, indicators, risk management, and the development of trading strategies.

Articles and Tutorials

The Admirals website hosts a vast collection of articles and guides on Forex and CFD trading that are accessible to traders of different levels. These materials include various trading and psychological techniques, market analysis tips, and more.

E-Book

The co-founder and president of the international group of companies Admirals, Alexander Tsikhilov, is the author of the book "Blockchain: Principles and Basics." This book demystifies the complex concepts of blockchain technology in an understandable language and can be helpful to a wide range of readers, regardless of their technical or financial education.

Customer Support

Admirals provides various communication channels, including email, phone, a feedback form, live chat, and a unique remote support service for technical issues. Despite rapid and constructive interaction, meaningful information about the support service's working hours is missing from the website. Moreover, some users in reviews on various resources note that support can be pushy and not always professional in their responses.

How to Contact Support?

You can contact Admirals technical support:

- via email at global@admiralmarkets.com;

- by phone at +442081577344 or +3726309306;

- through the feedback form;

- via the live chat on the website.

The broker offers remote support if a client has questions about the trading platform's operation. For this service, it is necessary to download and install special software on your device, which allows the technical support agent to see your desktop and promptly resolve any issues.

Admirals Pros and Cons

Advantages

Regulation. Admirals is regulated by several leading financial authorities, including the FCA in the UK and CySEC in Cyprus, ensuring high reliability and security.

Trading Fees. Trading commissions are set at a competitive level, making trading with Admirals cost-effective.

Wide Range of Payment Methods. Clients can deposit and withdraw funds using various convenient payment methods, including bank transfers, credit/debit cards, and electronic wallets.

Analytics. Admirals offers extensive analytical resources, including an economic calendar, trading news, weekly podcasts, and technical and fundamental analyses.

Education. The broker provides a rich collection of educational materials, including webinars, articles, guides, and e-books.

Disadvantages

High swaps. Long-term traders find it less profitable to trade on Admirals than on other platforms.

Support. Although the support service provides multiple communication channels and quick responses, some users sometimes complain about its intrusiveness and note unprofessionalism. Additionally, information about the support service's working hours is missing from the Admirals website.

Conclusion

The broker Admirals is suitable for a broad spectrum of traders. With its strict regulation, various account types, and a competent set of educational and analytical materials, this broker provides high-quality services for novice and experienced traders.

Beginners seeking detailed educational resources and support will undoubtedly appreciate this broker. Experienced traders will also find it beneficial due to competitive trading commissions, abundant tools for analysis and trading, and the convenience of the depositing and withdrawal process.

Forex and CFDs are complex products that are not suitable for everyone. They come with a high risk of losing money rapidly due to leverage. It would be best to consider whether you understand how CFDs work and whether you can afford to risk losing money.